Introduction

Sogenactif is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the implementation of the payment in instalments solution until the production starts.

Who does this document target

This document is intended to help you implement the payment in instalments.

The purpose is to present the functionalities related to the payment in instalments and to explain how to implement them with the Sogenactif solution.

To get an overview of the Sogenactif solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up

Prerequisites

Your customers' payment details must be stored in Sogenactif to allow you to make payments in instalments.

You have some points to process before starting:

- to be in compliance with the GDPR, you have to fill in your internal personal data processing register, specifying that banking data are maintained by Sogenactif. For more information on the GDPR, please refer to our documentation on information systems security;

- inform your customers about the storage of their details and the terms of payment in instalments (amount, number of instalments, ...);

Contacting the support

For any question or request for technical assistance, you can contact the usual Sogenactif support on 0 825 090 095 (0.15€/min + call charge - rate as of 02/11/2022) from Monday to Friday, from 9am to 7pm, excluding public holidays, or write to supportsogenactif@worldline-solutions.com specifying your VAD or MID contract number for a more efficient handling of your request.

Overview of the payment in instalments service

The payment in instalments has several components:

- setting up the due date when the first instalment is paid;

- processing of the subsequent due dates;

- management of the customer's means of payment expiration or of the one due dates refusal.

The payment methods allowing recurring payments to be made are : CB, Visa, Mastercard and Amex.

Choice of Sogenactif connectors for payment in instalments

As Sogenactif offers several interfaces to process payment in instalments, it is important to analyse your business needs to choose the most appropriate connectors for your situation.

There are two different integration modes for creating payments in instalments:

- via Sips Paypage: you send the details of each due date to Sogenactif: an authorisation will be made to pay the first instalment when getting the order. If the payment is accepted, all the instalments will be effectively created and sent to the bank on the requested date;

- via Sips Office, Sips Office Batch or Sips Office Extranet: you call

Sogenactif at each new due date: during the first payment

Sogenactif will process only this payment. You will have

to call Sogenactif again at each due date using one of the

following methods:

- Duplicate the first transaction (duplicate function)

- By creating a new transaction:

- via Sips Office Extranet or

- walletOrder function with the ID of the Sips WL wallet in which the CIT card is stored.

The table below summarises the available interfaces according to these two modes.

| Use cases | Sogenactif Paypage | Sogenactif Office Serveur | Sogenactif Office Batch | Sogenactif In-App | Sogenactif Gestion |

|---|---|---|---|---|---|

| Order placement and first due date (CIT) | V | V | X | V | X |

| Subsequent due dates (MIT) | Managed automatically by Sogenactif | Managed by the merchant | Managed by the merchant | X | V |

Data to retain

Depending on how you process due dates, the data to be retained varies:

| Connector | Data to be retained for processing MIT |

|---|---|

| Sogenactif Paypage | X |

| Sogenactif Office Serveur via Duplication function |

|

| Sogenactif Office Serveur via walletOrder |

|

Implementation

As a reminder, the customer must authenticate with 3-D Secure. The amount to be authenticated must be equal to the total amount of the order. For this type of payment, no exemption to strong authentication can be granted. For regulatory reasons, frictionless is not possible when setting up a payment in several instalments, there will necessarily be an authentication in Challenge mode. This first first due date benefits from the payment guarantee (unlike the following due dates).

The means of payment must be valid on the last due date (for example, in the case of cards, the expiration date shall not exceed the last due date). Otherwise, the payment will be refused.

Payment in instalments with Sogenactif Paypage

When the different payments are set up with Sogenactif Paypage, all the instalments will be created when the bank details are entered, as soon as the first payment is accepted.

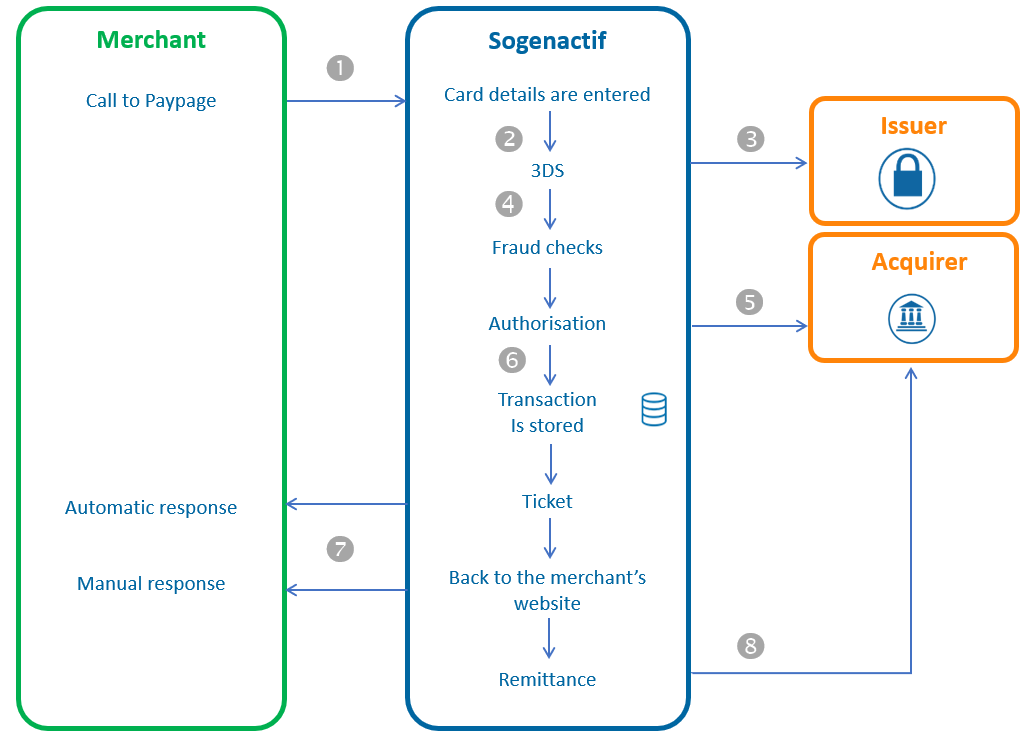

Order placement and 1st due date: CIT

Description

- To set up the instalment payment, you redirect the customer to Sogenactif Paypage by providing detailed information on all the deadlines in the request (reference, desired settlement date, amount, etc.).

- Sogenactif displays the payment page (only payment methods that support instalment payments are available), the customer selects the mean of payment, provides their payment details and then validates.

- Sogenactif performs the 3-D Secure verification.

- Sogenactif performs anti-fraud checks.

- Sogenactif sends a request for authorisation to the acquirer.

- Sogenactif records one transaction per due date in the back office.

- Sogenactif returns manual and automatic responses containing the details of the transaction.

- Sogenactif sends the transaction to settlement (if applicable) according to the terms you set up in the payment request.

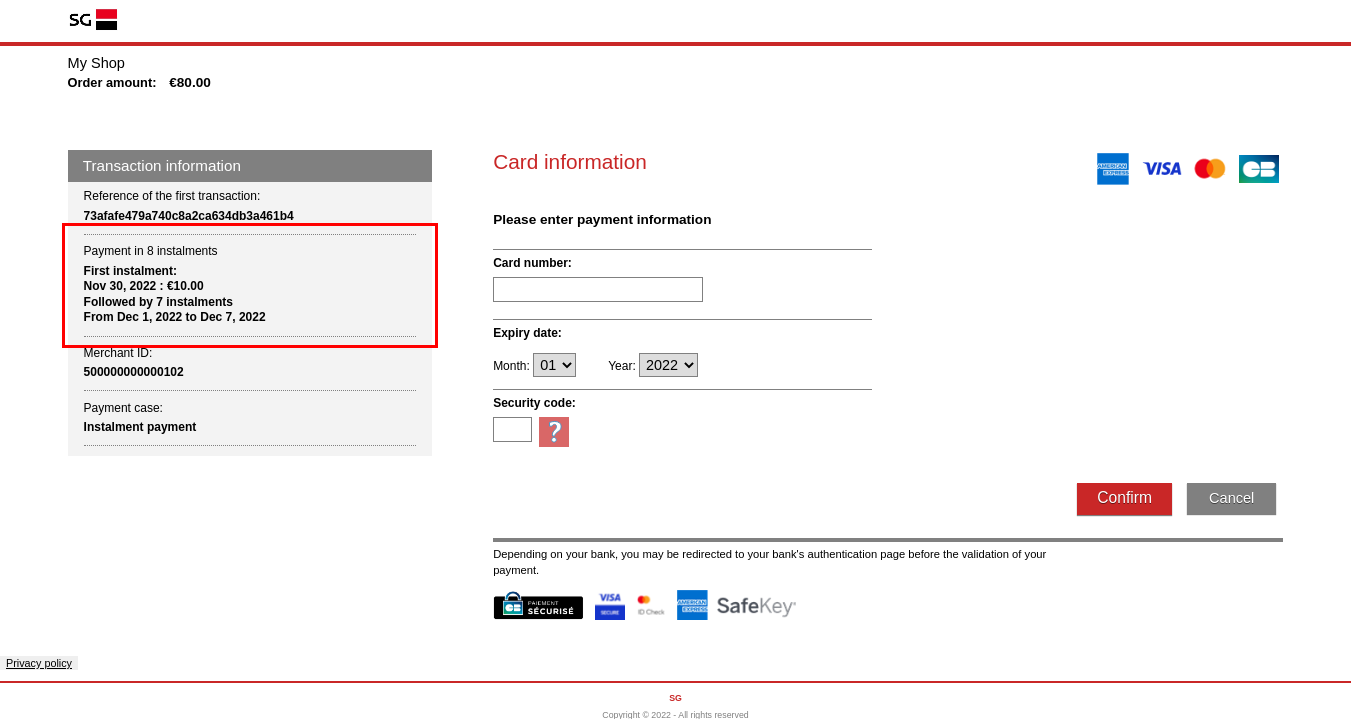

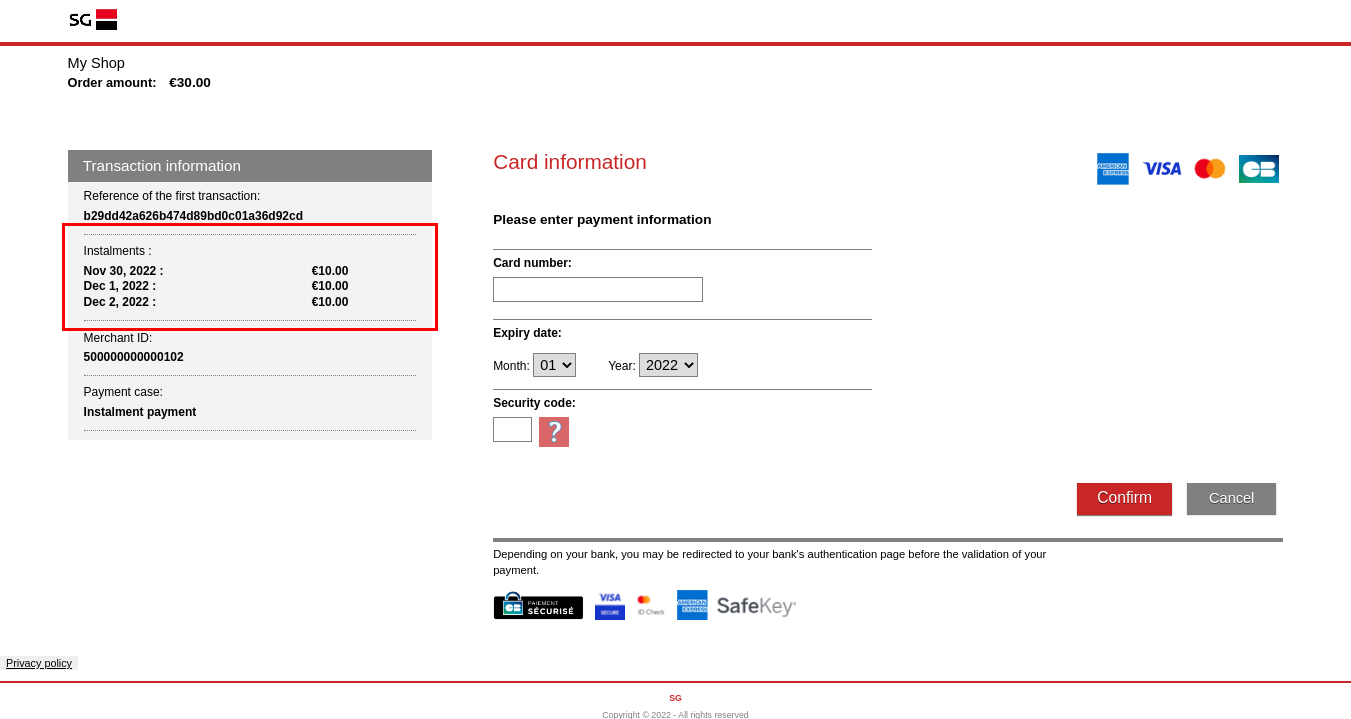

Payment page display

- display of each date and amount, if less than 5 due dates:

In the "Transaction information" block, under the section entitled "Instalments", each instalment with date and amount is displayed one below the other.

In the "Transaction information" block, under the section entitled "Instalments", each instalment with date and amount is displayed one below the other.

- display of the number of due dates, the start and end dates of the

transactions, if more than 5 due dates :In the "Transaction details" block, in the section entitled "Payment in x instalments" (x being the number of instalments), the following is displayed : First instalment: "first instalment date: amount" Followed by x instalments, from "first instalment date +1" to "last instalment date".

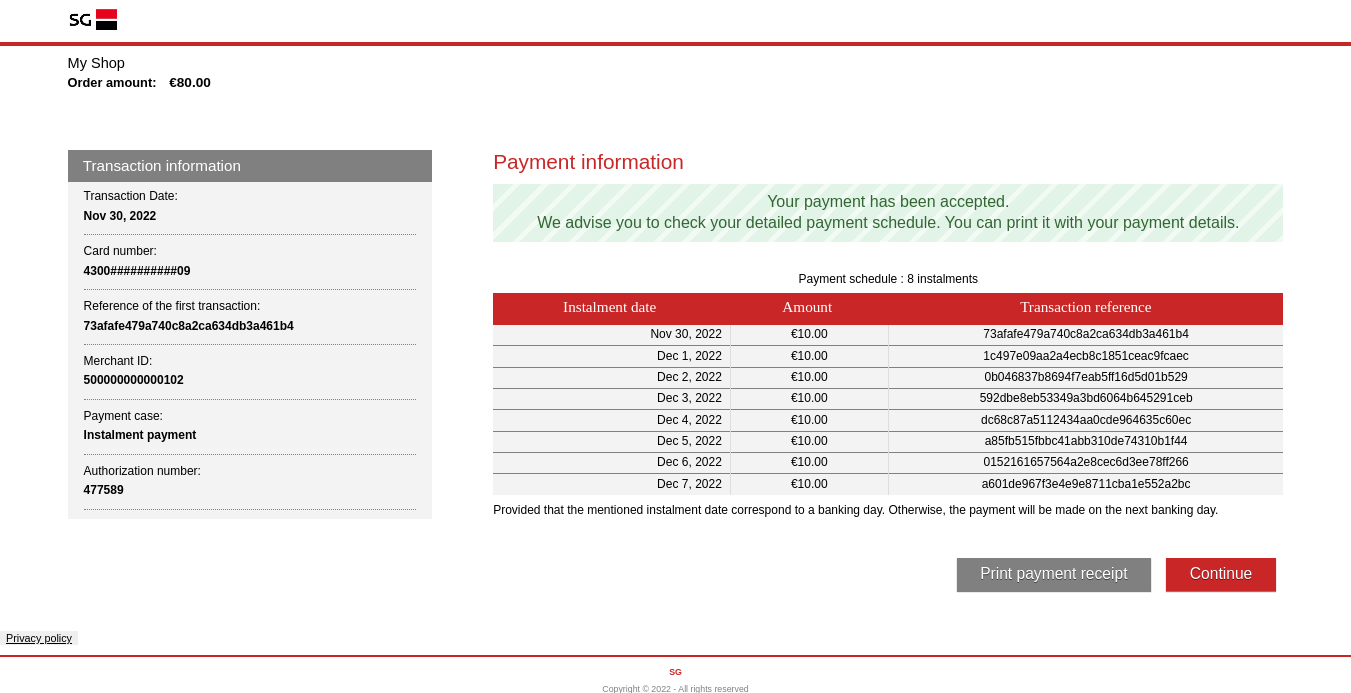

At the end of the process, the receipt displays the details of the due dates:

Below the message indicating that the payment has been accepted is a table with the instalment date in the first column, the amount in the second column and the transaction reference in the third column

Below the message indicating that the payment has been accepted is a table with the instalment date in the first column, the amount in the second column and the transaction reference in the third column

Setting the request

You need to fill in some parameters specifically to request the creation of an instalment payment.

| Field | Value setting rule |

|---|---|

paymentPattern |

INSTALMENT |

challengeMode3DS |

forced to CHALLENGE_MANDATE |

captureMode |

Forced by Sogenactif Paypage to AUTOR_CAPTURE regardless of the transmitted value. |

captureDay |

Ignored by Sogenactif Paypage, the dates provided

in the instalmentData.datesList

field make a reference. |

amount |

Must be equal to the sum of the due dates amounts

transmitted in the list instalmentData.amountList |

instalmentData.number |

number of due dates |

instalmentData.datesList |

The dates of each due date:

|

instalmentData.transactionReferencesList |

List of the transactionReference of each

due dates. The first element of the list must be equal to the

transactionReference field of

the request. |

instalmentData.amountsList |

List of transmitted due date amounts in due date order. The

sum of the amounts must be equal to the amount field . |

Please refer to one of the Sogenactif Paypage guides to know how to populate the other fields.

Analysing the response

Sogenactif returns a classic manual and automatic Sogenactif Paypage response.

The subscription related fields are as follows:

| Status | Response fields |

|---|---|

Transaction accepted (first payment made successfully). |

|

Transaction refused (first payment refused). |

responseCode = XX (other than

00) Please view the Sogenactif Paypage connector

guide to analyse the response of Sogenactif. |

Processing the subsequent due dates

Sogenactif processes the subsequent due dates automatically according to the requested remittance dates. This means that for each due date, Sogenactif will perform automatically an authorisation and remittance request (if applicable) on the requested day.

Sogenactif will combine each due date (MIT) with the transaction created during the first payment (CIT).

You can view the results of these transactions in your transaction report or on Sogenactif Gestion.

Paymenent in instalments with Sogenactif Office Serveur

You have the possibility to manage each due date of a payment in instalments with Sogenactif Office Serveur.

First, you make the initial payment to set up the due date. If this first payment is successful, several options are available:

- Duplicate the first transaction: combination is done by Sogenactif

- create new transactions using the walletOrder method: you must perform the CIT-MIT combination yourself.

Order placement and 1st due date: CIT

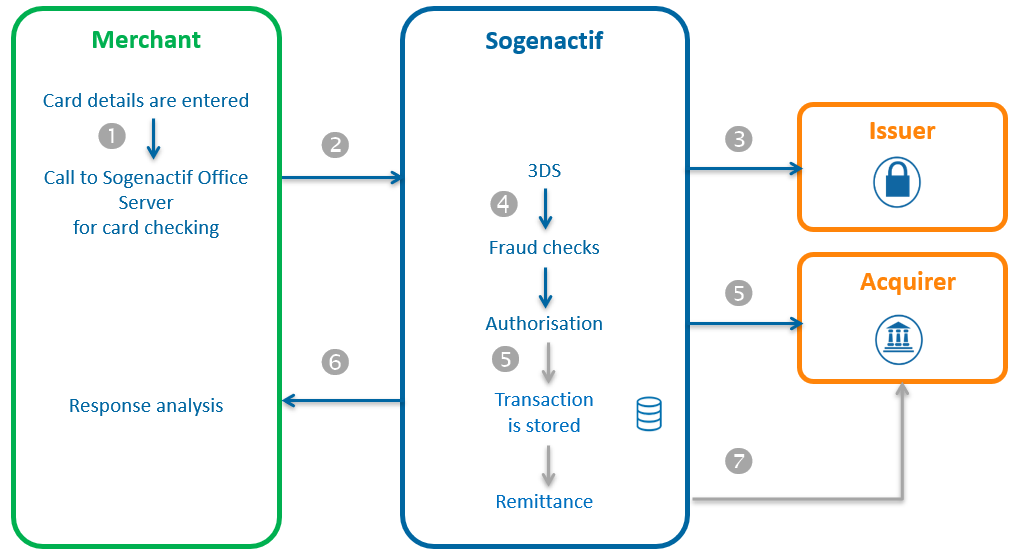

Description

- You display the payment due date on your website pages and ask your customer to enter their bank details.

- You make a request to Sogenactif Office Serveur, communicating in the request the detailed information about the overall order and the first due date.

- Sogenactif performs the 3-D Secure checking.

- Sogenactif performs anti-fraud checks.

- Sogenactif sends an authorisation request to the acquirer.

- Sogenactif saves the first due date in the back office.

- Sogenactif returns the result of the payment in the response.

- Sogenactif sends the transaction in remittance (if applicable) according to the terms you set up in the payment request.

Setting the request

The cardCheckEnrollment and

walletCheckEnrollmentmethods allow

you to initiate a payment in instalments with Sogenactif Office Serveur.

You have to fill in some specific parameters to request the creation of this type of payment.

| Field | Value setting rule |

|---|---|

paymentPattern |

INSTALMENT |

challengeMode3DS |

forced to CHALLENGE_MANDATE |

amount |

Must be set to the amount of the first due date. |

authenticationData.authentAmount |

Must be set to the overall order amount. |

recurringData.recurringSequence |

Must be set to 1 (the sequence of the due date in process). |

recurringData.recurringSequenceMax |

Must be set to the total number of due dates. |

recurringData.recurringPeriod |

Must be set to the minimum number of days between two consecutive due dates. |

recurringData.recurringEndDate |

Must be set to the last scheduled due date; |

Please view one of the Sogenactif Office Serveur guides to know how to populate the other fields.

Analysing the response

According to the response returned by Sogenactif Office Serveur, you determine the progress of this payment in instalments:

| Status | Response fields | Action to take |

|---|---|---|

Transaction accepted (first payment made successfully). |

|

You can process the order according to

the required guarantee level ( You keep the reference of this first transaction (CIT) which will be used for the subsequent due dates. |

Transaction refused (first payment refused). |

responseCode = XX (other than

00) Please view the Sogenactif Office Serveur connector guide to analyse the response of Sogenactif. |

You can offer your customer to pay with another means of payment by generating a new request. |

Processing the subsequent due dates

Via duplicate method

Calling up the duplication function allows you to make the payment for each subsequent due date (MIT).

Sogenactif Office Serveur is responsible for chaining each due date (MIT) with the transaction created at the time of the first payment (CIT).

Consult the connector guideSogenactif Office Serveur or Sogenactif Office Batch to set up the call to the duplicate method.

Via walletOrder method

Use of the walletOrder method if the card has been previously registered in the wallet Sogenactif (at the time of the CIT or earlier for a previous purchase). In addition to the standard fields of the method, you must send the following fields:

| Field | Value |

|---|---|

paymentPattern |

RECURRING_N |

initialSchemeTransactionIdentifier |

value of the schemeTransactionIdentifier field received in response from the CIT |

merchantWalletId |

ID of the wallet in which the card used in the CIT is stored |

paymentMeanId |

ID of the card used in the CIT within the wallet Sogenactif |

Summary

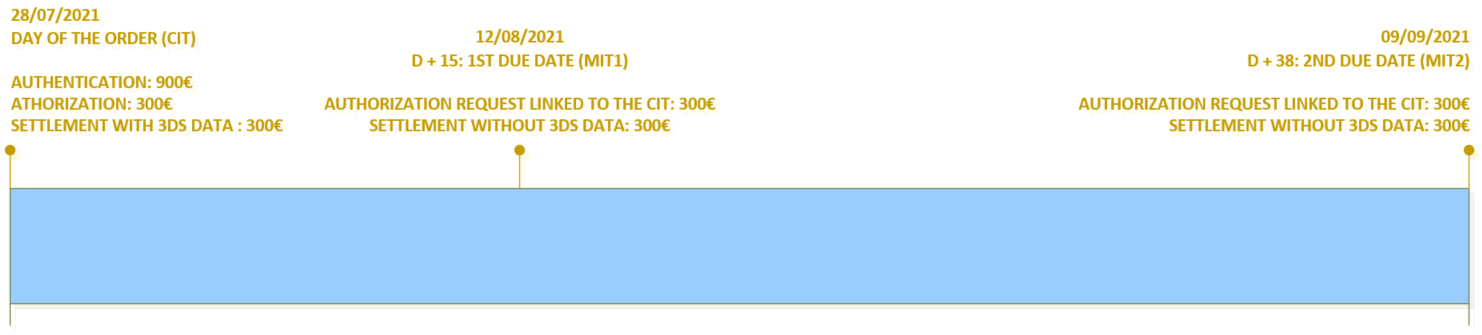

Sogenactif Paypage

Here is an example of payment in instalments with the connector :

Payment of an order of 900€ in three installments of 300€ each

- Day of order

- 3DS v2 authentication with total order amount (mandatory challenge): 900€.

- Authorisation request with 3DS data, first instalment: 300€

- Settlement without 3DS data: 300€

- Day of the 2nd due date

- CIT chained authorisation request: 300€

- Settlement without 3DS data: 300€

- Day of the 3rd due date

- CIT chained authorisation request: 300€

- Settlement without 3DS data: 300€

Parameters of the request:

| Field | CIT | MIT |

|---|---|---|

paymentPattern |

INSTALMENT | Managed by Sogenactif |

challengeMode3DS |

CHALLENGE_MANDATE | |

captureMode |

AUTHOR_CAPTURE | |

amount |

Sum of the due date amounts | |

instalmentData.datesList |

Dates of each due dates | |

instalmentData.transactionReferencesList |

TransactionReference of each due dates | |

instalmentData.amountsList |

Amount of each due dates | |

instalmentData.number |

Number of due dates |

Other connectors

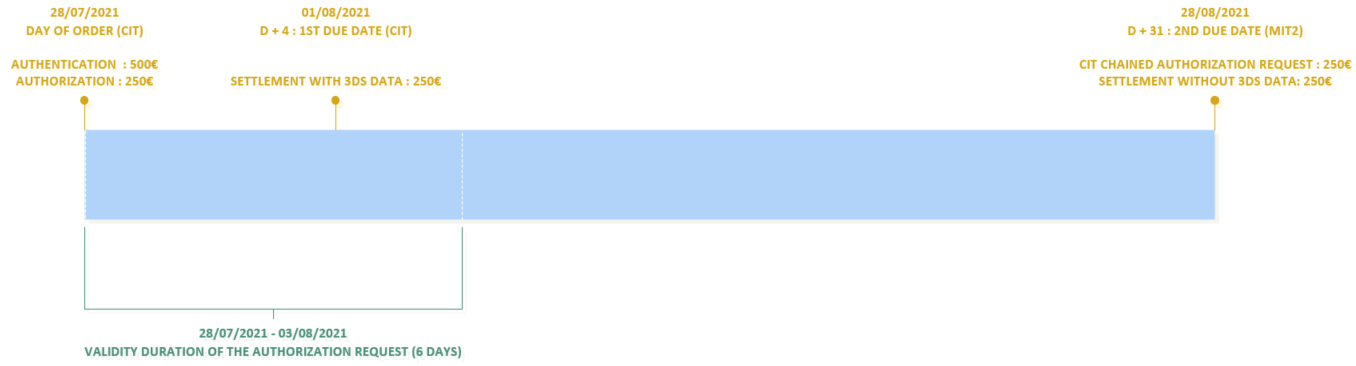

Payment in several instalments with 1st payment less than 6 days away

Here is an example of a payment in instalments with a first payment within 6 days:

Payment of an order of 500€ in 2 instalments:

- Day of order

- 3DS v2 authentication with total order amount (mandatory challenge): 500€.

- Authorisation request with 3DS data, first due date: 250€.

- Day of 1st due date

- Settlement with 3DS data: 250€

- Day of 2nd due date

- CIT chained authorisation request without 3DS data: 250€.

- Settlement without 3DS data: 250€

Connectors:

| CIT | MIT | |

|---|---|---|

| Connecteur |

|

|

Parameters of the request:

| Field | CIT | MIT via duplicate | MIT via walletOrder |

|---|---|---|---|

paymentPattern |

INSTALMENT | X | INSTALMENT |

challengeMode3DS |

CHALLENGE_MANDATE | X | X |

captureDay |

[ 0 , 6 ] | [ 0 , 99 ] | [ 0 , 99 ] |

captureMode |

AUTHOR_CAPTURE |

|

|

amount |

Amount of the fisrt due date | amount nth due date | amount nth due date |

authenticationData.authentAmount |

Total amount of the order | X | X |

recurringData.recurringSequence |

1 | X | Due date number |

recurringData.recurringSequenceMax |

Total number of due dates | X | X |

recurringData.recurringPeriod |

Maximum number of days between 2 consecutive due dates | X | X |

recurringData.recurringEndDate |

Date of the last due date | X | X |

initialSchemeTransactionIdentifier |

X | X | value of the schemeTransactionIdentifier field received in response from the CIT |

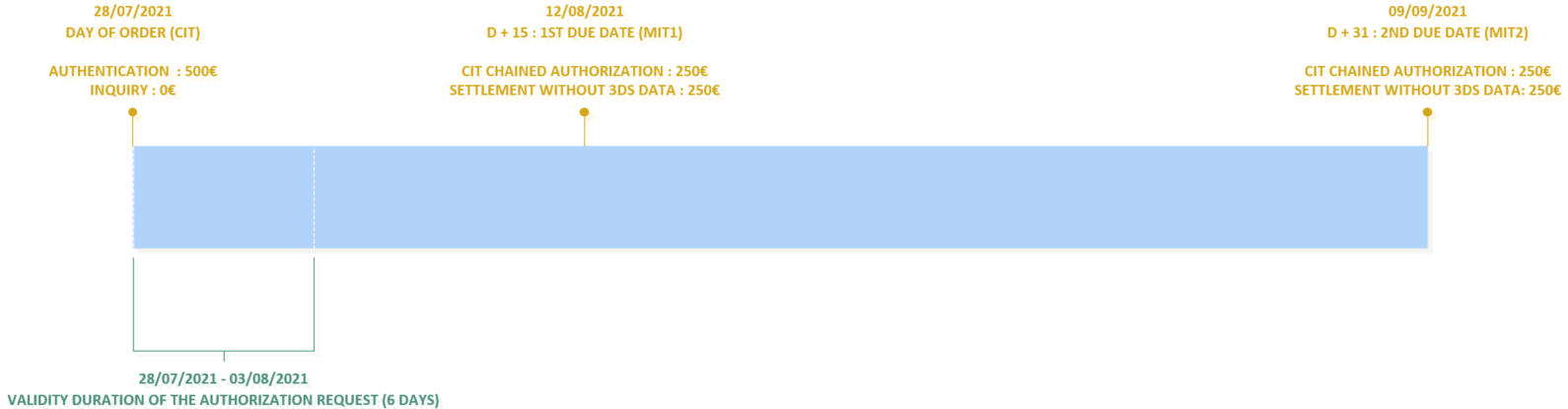

Payment in several instalments with 1st payment more than 6 days away

Here is an example of a payment in instalments with a first payment more than 6 days:

Payment of an order of 500€ in 2 instalments:

- Day of order

- 3DS v2 authentication with total order amount (mandatory challenge): 500€.

- Information request : authorisation with 3DS data: 0€.

- Day of 1st due date

- CIT chained authorization request without 3DS data: 250€.

- Settlement without 3DS data: 250€

- Day of 2nd due date

- CIT chained authorisation request without 3DS data: 250€.

- Settlement without 3DS data: 250€

Connectors:

| CIT | MIT | |

|---|---|---|

| Connecteur |

|

|

Parameters of the request:

| Field | CIT | MIT via duplicate | MIT via walletOrder |

|---|---|---|---|

paymentPattern |

INSTALMENT | X | INSTALMENT |

challengeMode3DS |

CHALLENGE_MANDATE | X | X |

captureDay |

[ 0 , 6 ] | [ 0 , 99 ] | [ 0 , 99 ] |

captureMode |

X |

|

|

amount |

0 | amount nth due date | amount nth due date |

authenticationData.authentAmount |

Total amount of the order | X | X |

recurringData.recurringSequence |

1 | X | Due date number |

initialSchemeTransactionIdentifier |

X | X | value of the schemeTransactionIdentifier field received in response from the CIT |

Starting payment in instalments in 4 steps

Step 1 - Implementing the service

When you have chosen the Sogenactif interfaces that meet your needs (cf. the paragraph Choice of connectors), you have to integrate the connectors to connect your website to Sogenactif and follow the instructions in the Implementation section.

Your shop must be configured on Sogenactif to accept payment in instalments. You have to ask SG to activate this service on your shop if it is not already done.

Step 2 - Testing the service on the test environment

Once you have implemented the Sogenactif connectors, you can do some tests to validate your integration.

| Test data | |

|---|---|

| merchantId | 201000076690001 |

| secret key | p64ifeYBVIaRcjaWoahCiw9L8wokNLqG2_YOj_POD4g |

| secret key version | 1 |

| test cards | cf page "Test cards" |

| Server | Test URL |

|---|---|

| Paypage POST | https://payment-webinit-sogenactif.test.sips-services.com/paymentInit |

| Paypage JSON | https://payment-webinit-sogenactif.test.sips-services.com/rs-services/v2/paymentInit |

| Paypage SOAP | https://payment-webinit-sogenactif.test.sips-services.com/services/v2/paymentInit |

| Office | https://office-server-sogenactif.test.sips-services.com |

transactionReference field in your

test requests.Step 3 - Subscribing to the production service

Your shop is not registered on Sogenactif.

If your shop has not yet been registered, you must fill in the registration form and return it to SG.

Your shop is already registered with Sogenactif.

If your shop is already registered with Sogenactif, you must check with SG to ensure to have access to Sogenactif Paypage or Sogenactif Office Serveur.

Step 4 - Starting and validating the service in production

You must change the URL to connect to the Sogenactif production server using the credentials you received when registering merchantId, secretKey, and keyVersion.

| URL Sogenactif | URL of the Sogenactif payment server retrieved by e-mail. |

| MerchantId | Shop ID received by e-mail. |

| SecretKey | Secret key you retrieve via the Sogenactif Téléchargement. |

| KeyVersion | Secret key version retrieved on Sogenactif Téléchargement (obviously 1 for the 1st key). |

If you want to customise your payment pages, please follow the procedure described in the Custompages documentation.